With ethereum address coinbase at the forefront, navigating the world of cryptocurrency becomes a thrilling and rewarding journey. Whether you’re a seasoned trader or just starting out, understanding how to manage your Ethereum address on Coinbase is crucial for making secure transactions.

This guide will delve into the fundamentals of Ethereum addresses, the advantages of using Coinbase, and the steps needed to effectively send and receive Ethereum. By the end, you’ll be well-equipped to handle your Ethereum transactions with confidence.

Introduction to Ethereum Addresses

Ethereum addresses are a crucial component of the Ethereum blockchain, serving as the unique identifiers for accounts on the network. These addresses facilitate the sending and receiving of Ether and other tokens, enabling users to transact with confidence in a decentralized environment. Each Ethereum address is derived from a public-private key pair, which is fundamental to the security and functionality of cryptocurrency transactions.The generation of an Ethereum address involves the use of cryptographic algorithms that create a public key from a private key.

The public key is then hashed using the Keccak-256 hash function to produce the Ethereum address. This process ensures that each address is unique and securely tied to its corresponding private key, which must be kept confidential to protect the user’s funds. Ethereum addresses play an essential role in enabling transactions on the Ethereum network by serving as the destination for transactions initiated by users or smart contracts.

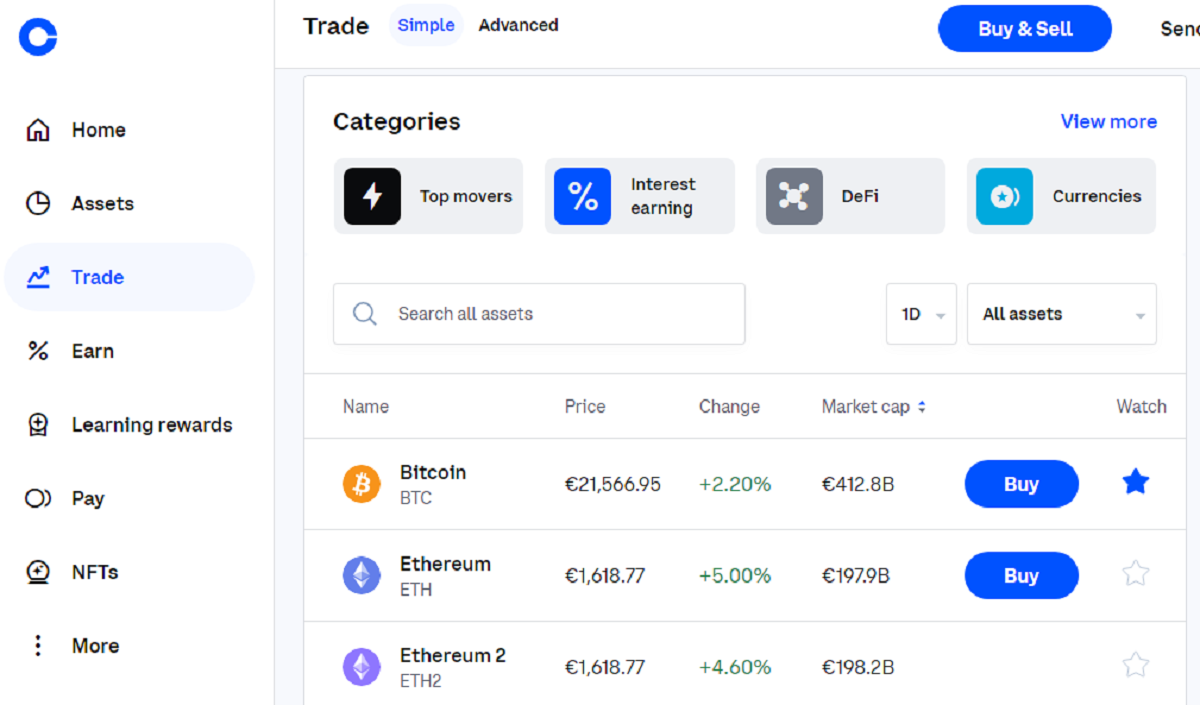

Overview of Coinbase

![How to Find Your Coinbase Wallet Address [2024 Update] How to Find Your Coinbase Wallet Address [2024 Update]](https://coinwire.com/wp-content/uploads/2022/12/4.-find-coinbase-wallet-address-on-web-browser-step-3.jpg)

Coinbase is one of the leading cryptocurrency exchange platforms, allowing users to buy, sell, and manage various cryptocurrencies, including Ethereum. Established in 2012, Coinbase has built a reputation for its user-friendly interface and robust security measures. The platform caters to both beginners and seasoned traders, offering a range of services tailored to different user needs.When it comes to Ethereum, Coinbase provides a seamless experience for users looking to engage with this cryptocurrency.

The platform allows users to purchase Ethereum using traditional payment methods, such as credit and debit cards, or via bank transfers. Additionally, Coinbase offers a digital wallet service where users can store their Ethereum securely. The advantages of using Coinbase for Ethereum transactions include its strong security protocols, easy-to-navigate interface, and responsive customer support, making it a preferred choice for many users.

Creating an Ethereum Address on Coinbase

Creating an Ethereum wallet on Coinbase is a straightforward process that allows users to manage their Ethereum securely. To set up an Ethereum address on the platform, users need to follow a series of steps. First, they must create a Coinbase account by providing basic information such as their name, email address, and a secure password. After verifying their email, users can complete the identity verification process, which involves submitting identification documents.Here’s a checklist of requirements needed to set up an Ethereum address on Coinbase:

- Valid email address

- Secure password

- Government-issued ID for identity verification

- Mobile phone for two-factor authentication

Once the account is created, users can easily manage their Ethereum address by logging into their Coinbase account and accessing the wallet section. It’s crucial to securely manage this address by enabling two-factor authentication and regularly updating passwords to protect against unauthorized access.

Sending and Receiving Ethereum through Coinbase

Sending Ethereum to an external wallet using a Coinbase address is a simple process. Users can initiate a transfer by navigating to the “Send/Receive” option in the wallet section of their account. After selecting Ethereum as the currency, users need to enter the recipient’s Ethereum address and the amount they wish to send. It is essential to double-check the recipient’s address to avoid any irreversible mistakes.Receiving Ethereum into a Coinbase account also involves straightforward steps.

Users can generate their unique Ethereum address within the wallet section and share it with the sender. It is vital to encourage users to verify the Ethereum addresses before completing transactions to ensure that funds are sent to the correct destination.

Security Considerations for Ethereum Addresses

Security risks associated with Ethereum addresses and transactions can pose significant threats to users. Common risks include phishing attacks, unauthorized access, and loss of private keys. Users must be vigilant and adopt best practices to secure their Ethereum addresses on Coinbase, such as enabling two-factor authentication and using strong, unique passwords.To recover access to a lost or compromised Ethereum address, users should follow the recovery procedures provided by Coinbase.

This may involve resetting passwords, confirming identity through verification methods, or seeking support from Coinbase’s customer service.

Troubleshooting Common Issues

Resolving issues related to Ethereum address transactions on Coinbase may require users to follow specific guidelines. Common problems could include failed transactions due to insufficient funds, incorrect addresses, or network congestion. Users should check their transaction history for any alerts or messages indicating the nature of the issue.To handle failed transactions involving Ethereum, users should first verify the details of the transaction, including recipient addresses and amounts.

If issues persist, contacting Coinbase support for assistance is recommended. Examples of common mistakes include sending Ethereum to a non-Ethereum address or failing to account for network fees. By providing clear instructions and reminders, users can avoid these pitfalls.

Future of Ethereum and Coinbase Integration

Looking ahead, Coinbase is expected to introduce new features and updates that enhance user experience with Ethereum. As the Ethereum network evolves, including developments like Ethereum 2.0 and layer-2 solutions, exchanges like Coinbase will adapt to accommodate these changes.Potential trends in the use of Ethereum addresses within the cryptocurrency ecosystem may include increased integration of decentralized applications (dApps) and enhanced interoperability between different blockchains.

As such, staying informed about these developments is crucial for users engaged in Ethereum transactions.

End of Discussion

In conclusion, mastering the use of your ethereum address on Coinbase not only enhances your trading experience but also ensures that your assets remain secure. As the cryptocurrency landscape continues to evolve, staying informed about best practices and new features will empower you to make the most of your investments.

Expert Answers

What is an Ethereum address?

An Ethereum address is a unique identifier that allows users to send and receive Ethereum and other tokens on the Ethereum network.

How do I create an Ethereum address on Coinbase?

You can create an Ethereum address on Coinbase by signing up for an account and following the prompts to set up your Ethereum wallet.

Is Coinbase safe for storing Ethereum?

Yes, Coinbase employs robust security measures, but it’s always advisable to use additional methods like hardware wallets for enhanced protection.

Can I send Ethereum to any Ethereum address?

Yes, you can send Ethereum to any valid Ethereum address, but ensure that the address is correct to avoid losing your funds.

What should I do if I lose access to my Ethereum address?

If you lose access, you should follow Coinbase’s recovery procedures, which may involve verifying your identity.