Crypto coins graphs are essential tools in the fast-paced world of digital currency trading, providing traders with a visual representation of market movements and trends. By analyzing these graphs, traders can make educated decisions based on past performance and projected trends, ultimately navigating the volatile crypto landscape more effectively.

These graphs come in various formats, including line charts, bar charts, and candlestick charts, each offering unique advantages for visualizing data. As we explore the types of graphs, methods of analysis, and tools available for creating them, you’ll gain insights into how to leverage these resources to your benefit in the cryptocurrency market.

Introduction to Crypto Coins Graphs

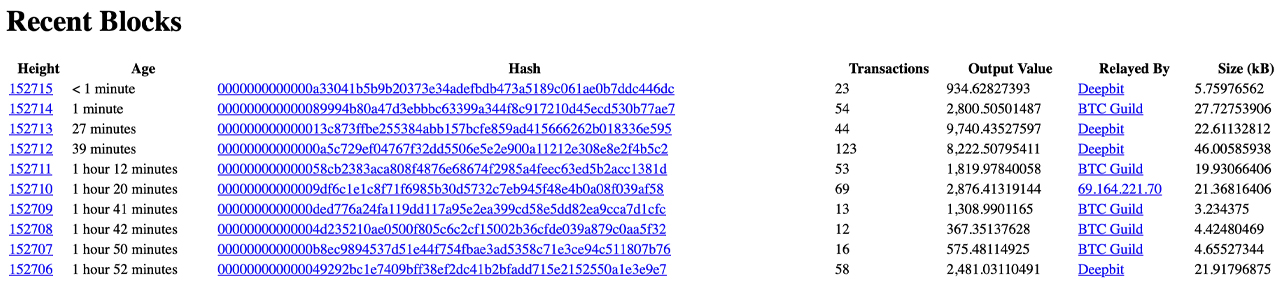

In the dynamic world of digital currency trading, understanding the significance of crypto coins graphs is crucial for traders and investors. These graphs serve as visual representations of price movements and trading volumes, allowing users to make informed decisions based on market trends. By analyzing these graphs, traders can identify patterns, spot potential entry and exit points, and gauge market sentiment.A typical crypto coins graph consists of several key elements including price, time, volume, and various indicators.

The axes represent time on the horizontal line and price on the vertical line, with data points plotted to show historical price movements. Popular examples of crypto coins graphs include the Bitcoin price chart, Ethereum price chart, and Litecoin price chart, which are widely used by traders to analyze market behavior and trends.

Types of Crypto Coins Graphs

There are various types of graphs utilized in the cryptocurrency sphere, each with its unique characteristics and advantages. The primary types include:

- Line Charts: These represent price movements over time using a continuous line. They are straightforward and excellent for identifying trends but may lack detail on price volatility.

- Bar Charts: Bar charts display open, close, high, and low prices within a specific time frame. They offer more information than line charts but can be more complex to interpret.

- Candlestick Charts: These charts provide detailed insights into price movements, showing the open, high, low, and close prices in a single candlestick. They are favored by traders for their ability to convey market sentiment and potential reversals.

Comparing these graph types reveals strengths and weaknesses. Line charts are simple but may miss essential details. Bar charts offer more insights but can overwhelm beginners. Candlestick charts combine detail and clarity, making them a powerful tool for experienced traders.

Understanding Market Trends through Graphs

Analyzing crypto coins graphs is essential for interpreting market trends effectively. Traders can identify bullish trends, characterized by rising prices, and bearish trends, indicated by falling prices. For instance, a graph showing consistent higher highs and higher lows signals a bullish trend, while lower lows and lower highs indicate a bearish trend.Historical data is crucial in these graphs, as it allows traders to recognize patterns and predict future movements.

For example, if a cryptocurrency consistently shows price increases after a specific period of consolidation, traders may anticipate similar behavior in the future.

Tools and Software for Graph Analysis

A wide array of tools and software are available for generating and analyzing crypto coins graphs. Some of the most popular include TradingView, Coinigy, and CryptoCompare. Each of these platforms offers unique features catering to different trading styles and preferences.To illustrate how to use a specific tool, here’s a step-by-step guide for TradingView:

- Sign up for a TradingView account.

- Navigate to the chart section and select the cryptocurrency you wish to analyze.

- Choose your preferred graph type (line, bar, or candlestick).

- Use indicators and drawing tools to enhance your analysis.

- Save your chart for future reference.

Here’s a table summarizing the features of different graphing tools:

| Tool | Features | Best For |

|---|---|---|

| TradingView | Customizable charts, social features, integrated indicators | Interactive analysis |

| Coinigy | Real-time data, trading capabilities, portfolio management | Comprehensive trading |

| CryptoCompare | Price comparisons, historical data | Market research |

The Role of Volume in Crypto Graphs

Trading volume plays a critical role in interpreting crypto coins graphs. It reflects the number of units traded over a specific timeframe and can significantly impact price movements. Higher trading volumes often indicate stronger market interest, while lower volumes may suggest a lack of enthusiasm.Volume indicators are typically represented by bars at the bottom of the graph, providing a visual representation of trading activity.

Understanding volume trends can help traders make better decisions regarding market entry and exit points.

“High trading volume often confirms a price trend, while low volume may signal a reversal.”

Predictive Analysis Using Graphs

Crypto coins graphs can be powerful tools for predictive analysis in trading decisions. By studying historical patterns and combining different types of graphs, traders can enhance their predictive accuracy. For example, using candlestick charts alongside volume indicators can provide insights into potential price movements.A comparison of predictive outcomes from various graph types reveals the following trends:

| Graph Type | Predictive Accuracy |

|---|---|

| Line Charts | Moderate |

| Bar Charts | High |

| Candlestick Charts | Very High |

Case Studies of Notable Graphs

Examining significant cryptocurrency events through graphs provides valuable insights into market behavior. For instance, the 2017 Bitcoin bull run can be illustrated through a graph highlighting rapid price increases, while the subsequent market correction can showcase sharp declines.Key takeaways from these case studies include:

- Market sentiment plays a crucial role in price movements.

- Historical patterns can repeat, aiding in future predictions.

- Price corrections often follow significant bull runs.

Ultimate Conclusion

In conclusion, understanding crypto coins graphs is crucial for anyone looking to thrive in cryptocurrency trading. From recognizing market trends to utilizing sophisticated tools for analysis, these graphs serve as invaluable assets. By mastering the insights they provide, traders can enhance their decision-making processes and potentially increase their success in the ever-evolving digital currency arena.

FAQ Insights

What are crypto coins graphs used for?

Crypto coins graphs are used to visualize price movements, market trends, and trading volumes, helping traders make informed decisions.

How can I interpret a candlestick chart?

A candlestick chart shows price movements over time, with each “candlestick” representing the open, close, high, and low prices for a specific time period.

Why is trading volume important in crypto graphs?

Trading volume indicates the amount of currency traded during a specific period, providing insight into market activity and the strength of price movements.

Can I use mobile apps for analyzing crypto graphs?

Yes, many mobile apps are available that allow users to generate and analyze crypto coins graphs on the go.

Are historical data important for predicting future trends?

Absolutely, historical data is crucial as it helps identify patterns and trends that can inform future trading strategies.