Exploring the realm of crypto gen companies offers a fascinating glimpse into the future of finance and technology. These companies play a pivotal role in the blockchain ecosystem, driving innovation and reshaping how we perceive value and transactions.

From exchanges to wallet providers, crypto gen companies vary widely in function and purpose, each contributing uniquely to the marketplace. As technological advancements continue to emerge, the significance of these entities becomes increasingly apparent, making them essential players in the evolving digital landscape.

Introduction to Crypto Gen Companies

Crypto gen companies represent a new wave of businesses that focus on utilizing blockchain technology to create innovative solutions in the digital currency space. These companies play a critical role in the blockchain ecosystem by facilitating transactions, providing secure storage, and enabling users to interact with cryptocurrencies in various capacities. The importance of innovation in crypto gen companies cannot be overstated, as it drives the evolution of the market and enhances security, accessibility, and usability for end-users.

Types of Crypto Gen Companies

There are several distinct types of crypto gen companies, each serving a unique purpose within the blockchain ecosystem. They include exchanges, wallets, mining firms, and more. Understanding these categories is essential for anyone looking to navigate the crypto landscape effectively.

- Exchanges: Platforms that allow users to buy, sell, and trade cryptocurrencies. Examples include Coinbase and Binance.

- Wallets: Services that provide storage for cryptocurrencies, allowing users to manage their digital assets. Some well-known wallets are Ledger and MetaMask.

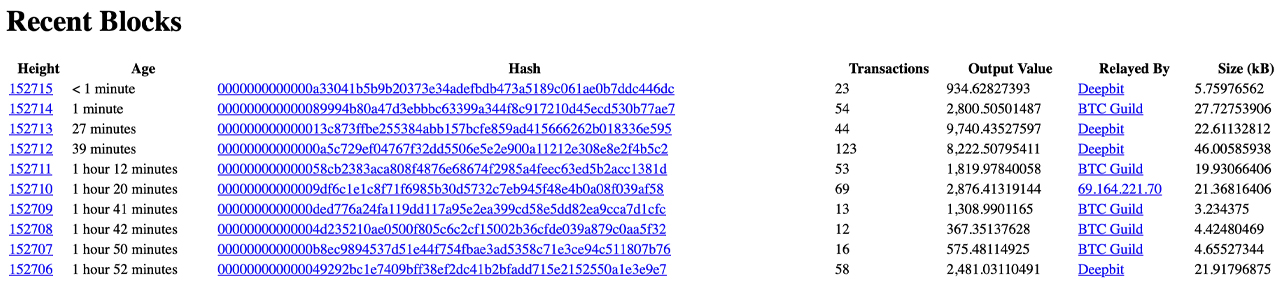

- Mining Firms: Companies that engage in the process of validating transactions on the blockchain and earning rewards in the form of cryptocurrencies. Notable examples include Bitmain and Hive Blockchain.

| Type | Features | Functions |

|---|---|---|

| Exchanges | Trading pairs, liquidity, user-friendly interfaces | Facilitating trades, price discovery |

| Wallets | Security features, multi-currency support | Storing and managing cryptocurrencies |

| Mining Firms | High processing power, energy-efficient operations | Validating transactions, securing the network |

Business Models of Crypto Gen Companies

Crypto gen companies employ various business models to sustain their operations and generate revenue. These models often reflect the specific services they provide and the market dynamics they operate within.

- Transaction Fees: Most exchanges charge a fee for each trade, providing a significant revenue stream.

- Staking: Companies offering staking services earn income from the fees associated with managing staked assets.

- Subscription Models: Wallets might utilize subscription services for premium features or enhanced security.

“Understanding the business models is crucial for investors looking to assess the financial health of crypto gen companies.”

Technological Innovations by Crypto Gen Companies

Technological advancements in the crypto space are often spearheaded by crypto gen companies, which strive to enhance user experience and security. Innovations such as decentralized finance (DeFi), non-fungible tokens (NFTs), and layer-2 scaling solutions are a testament to this drive for progress.Case studies like Uniswap, which revolutionized decentralized trading, and Ethereum’s transition to Proof of Stake illustrate how these innovations can enhance the overall ecosystem.

These advancements have not only improved transaction speeds and reduced costs but have also significantly bolstered user security.

Regulatory Challenges Faced by Crypto Gen Companies

The regulatory landscape for crypto gen companies is complex and varies significantly across different jurisdictions. Key regulations include anti-money laundering (AML) provisions, know your customer (KYC) requirements, and securities laws, all of which can impact company operations and compliance.

| Region | Regulatory Challenges |

|---|---|

| United States | Strict AML and KYC compliance requirements |

| European Union | GDPR compliance and MiFID II regulations |

| Asia | Diverse regulations across countries, often with varying levels of acceptance |

Future Trends for Crypto Gen Companies

The crypto industry is poised for significant changes in the coming years, with trends such as increased institutional adoption, advancements in interoperability, and the rise of Web3 technologies. These shifts will likely influence the strategies of crypto gen companies as they adapt to meet the evolving demands of the market.Emerging technologies such as artificial intelligence (AI), blockchain interoperability solutions, and advanced cryptographic methods could reshape how these companies operate and interact with users, enhancing both functionality and security.

Investment Opportunities in Crypto Gen Companies

Investors considering opportunities in crypto gen companies should evaluate factors like market volatility, user adoption rates, and regulatory developments. Conducting thorough market analysis and employing valuation techniques tailored to the unique characteristics of the crypto space are essential for informed decision-making.

| Investment Aspect | Potential Risks | Potential Rewards |

|---|---|---|

| Market Volatility | Price fluctuations can lead to loss | High returns in a bullish market |

| Regulatory Changes | Compliance risks can affect operations | Strong brands may benefit from clearer regulations |

Community and Ecosystem Engagement

Community engagement is vital for the success of crypto gen companies, as a strong user base can drive adoption and loyalty. Strategies for building and maintaining a community include fostering open communication channels, organizing educational initiatives, and incentivizing participation through token rewards.Successful community-driven initiatives, such as governance tokens in decentralized finance projects, highlight how engagement can lead to better decision-making and enhanced user satisfaction.

Outcome Summary

In summary, crypto gen companies embody the spirit of innovation in the financial sector, navigating challenges and capitalizing on opportunities within a dynamic market. As we look ahead, the continued evolution of these companies will undoubtedly influence both the industry and the broader economic environment, making them a critical focus for investors and enthusiasts alike.

General Inquiries

What is a crypto gen company?

A crypto gen company refers to a business that operates within the cryptocurrency sector, focusing on services like exchanges, wallets, and blockchain technology.

How do crypto gen companies impact the blockchain ecosystem?

They facilitate transactions, enhance security, and drive technological advancements that improve user experiences and accessibility in the blockchain space.

What are the main revenue streams for these companies?

Crypto gen companies typically generate revenue through transaction fees, staking, and offering premium services to users.

What are some examples of successful crypto gen companies?

Notable examples include Coinbase for exchanges, MetaMask for wallets, and Bitmain for mining technology.

What challenges do crypto gen companies face?

Regulatory compliance, market volatility, and technological security are major challenges that these companies must navigate.