Exploring the world of crypto coin app in usa opens up a vibrant landscape where technology and finance intersect. As digital currencies gain traction, crypto apps have become essential tools for both seasoned traders and newcomers alike, facilitating easy access to the market and simplifying transactions.

These applications not only allow users to buy, sell, and manage their cryptocurrency portfolios but also offer a variety of features that enhance user experience and security. With the rapid growth of cryptocurrency in the USA, understanding the dynamics of these apps is crucial for anyone looking to navigate this evolving financial frontier.

Overview of Crypto Coin Apps in the USA

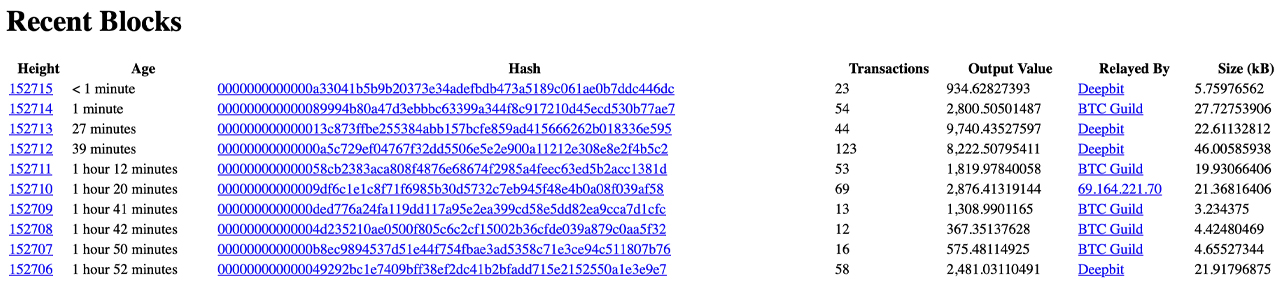

The rise of cryptocurrency has led to a surge in the development and adoption of crypto coin applications in the United States. A crypto coin app is essentially a mobile application that allows users to buy, sell, trade, and manage various cryptocurrencies. These apps serve multiple functions, including wallet services, market tracking, and trading platforms that facilitate transactions.The growth of cryptocurrency applications in the USA has been remarkable, with millions of users jumping on the bandwagon.

According to recent statistics, the number of users engaging with crypto apps has crossed the 50 million mark, with transaction volumes exceeding $200 billion in recent months. This rapid expansion reflects both the increasing public interest in digital currencies and the convenience these apps offer.

Features of Popular Crypto Coin Apps

When it comes to popular crypto coin apps, several features make them stand out in the crowded marketplace. The following is a list of common features found in leading crypto apps:

- User-friendly interfaces for easy navigation

- Real-time market data and price alerts

- Secure wallet integration for holding various cryptocurrencies

- Multiple payment options, including credit cards and bank transfers

- Two-factor authentication for enhanced security

- In-app trading features for seamless transactions

- Educational resources for beginners to learn about cryptocurrencies

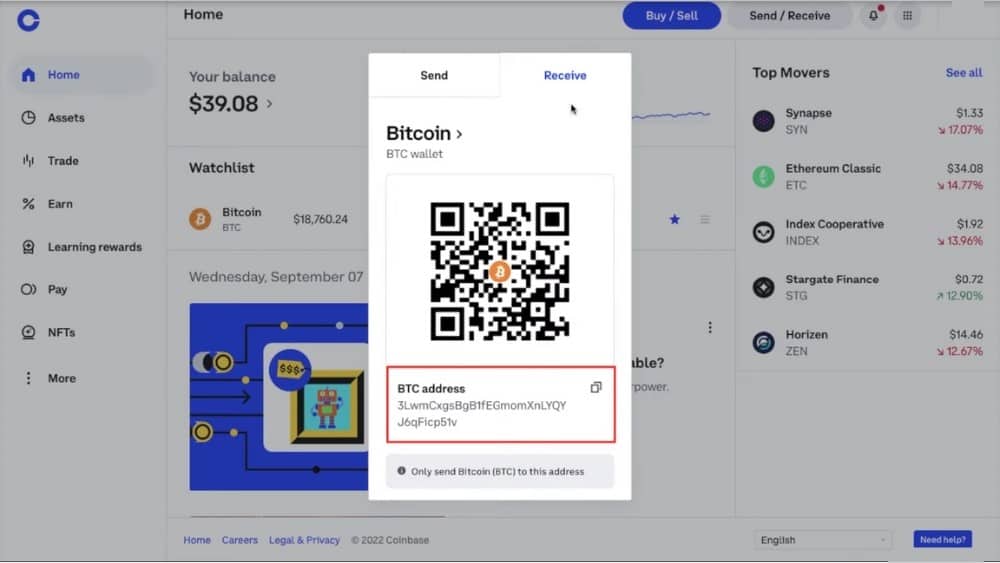

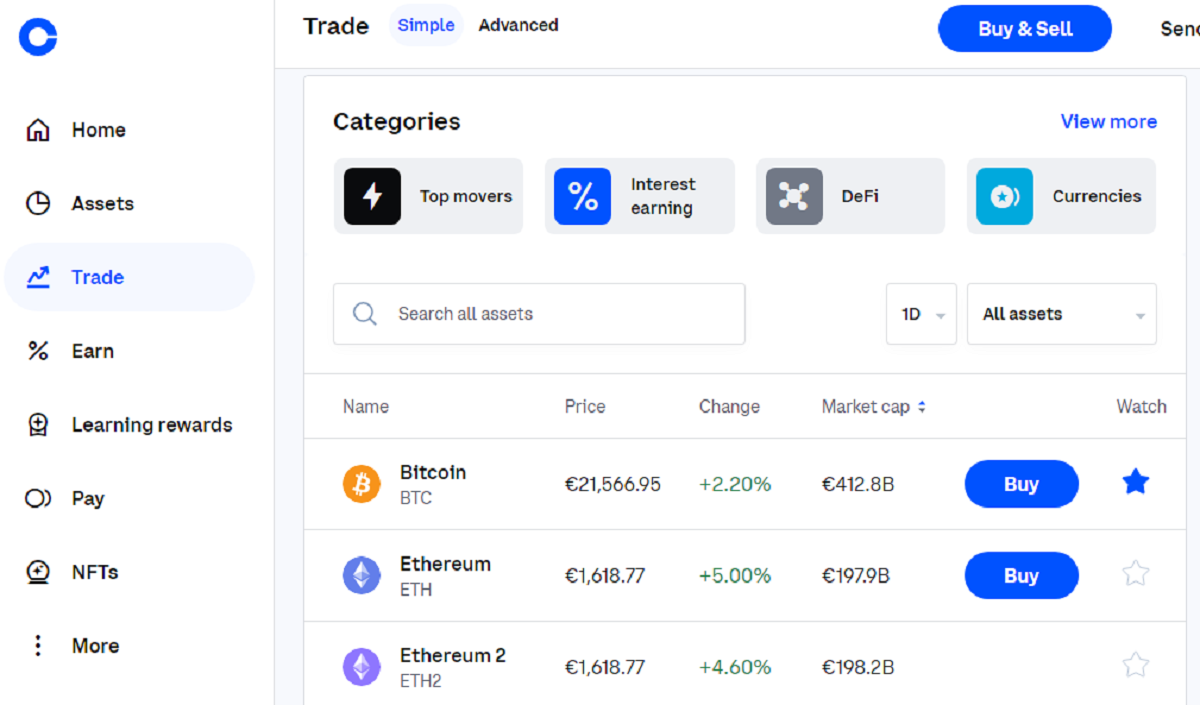

A comparison of the user interfaces of three popular apps—Coinbase, Binance, and Kraken—reveals distinct styles. Coinbase features a sleek, minimalistic design ideal for beginners, while Binance offers a more complex interface suitable for experienced traders. Kraken, on the other hand, combines both simplicity and advanced features, making it versatile for users of varying skill levels.In terms of security measures, top-rated applications implement robust protocols like end-to-end encryption, secure storage of private keys, and regular security audits to protect user data and funds.

Benefits of Using Crypto Coin Apps

Using crypto coin apps brings several advantages over traditional trading methods. The primary benefit is convenience, as users can trade and manage their portfolios from anywhere with an internet connection. Furthermore, these apps enhance accessibility to cryptocurrency for beginners, offering tutorials and resources that simplify the learning curve associated with digital currencies.Mobile applications significantly improve user experience by providing instant notifications, real-time market updates, and simplified transaction processes.

This immediacy allows users to react quickly to market changes, maximizing their trading potential.

Risks and Challenges of Crypto Coin Apps

Despite their many benefits, crypto coin apps come with potential risks. One significant risk is the volatility of cryptocurrencies, which can lead to substantial financial losses if users are not careful. Additionally, legal and regulatory challenges are prevalent in the USA, as different states impose varying rules and regulations on cryptocurrency trading and operations.Common user mistakes, such as neglecting to secure accounts or failing to stay informed about market trends, can lead to serious financial setbacks.

To avoid these pitfalls, users should prioritize education, utilize strong passwords, and regularly update their security settings.

Comparison of Leading Crypto Coin Apps

Below is a comparative table summarizing the features, fees, and security of different crypto coin apps:

| App Name | Features | Fees | Security Measures |

|---|---|---|---|

| Coinbase | User-friendly, multiple cryptocurrencies | Varied, up to 1.49% for trades | Two-factor authentication, insurance for stored funds |

| Binance | Advanced trading options, high liquidity | 0.1% trading fee, discounts for token holders | Cold storage for funds, regular audits |

| Kraken | Wide variety of cryptocurrencies, margin trading | 0-0.26% based on volume | Two-factor authentication, PGP encryption |

Each app has its pros and cons. For instance, Coinbase is ideal for beginners but has higher fees. Binance offers advanced features but can be overwhelming for new users. Kraken strikes a balance but may lack user-friendly design.User reviews often highlight the strengths and weaknesses of these apps, with many praising the ease of use of Coinbase and the extensive features of Binance.

However, concerns about fees and customer support are common across the board.

Future Trends in Crypto Coin Apps

The future of crypto coin apps is likely to see the integration of advanced features like AI-driven trading strategies and enhanced user personalization. Emerging technologies such as blockchain-based identity verification could also revolutionize how users interact with these applications.Additionally, shifts in user demographics, particularly among younger generations who are more tech-savvy, may influence how these apps evolve. As digital currencies become more mainstream, the demand for features that cater to casual investors will likely grow.

How to Choose the Right Crypto Coin App

Selecting the right crypto coin app involves careful consideration of several criteria. Users should evaluate aspects like security measures, user interface design, available cryptocurrencies, and trading fees. A checklist can help streamline the decision-making process:

- Security features, such as two-factor authentication

- Usability of the app interface

- Range of supported cryptocurrencies

- Fee structures and commissions

- Quality of customer support

Moreover, assessing user reviews and ratings can provide valuable insights into the app’s performance and reliability. Emphasizing app security and customer support is crucial, as these factors play significant roles in protecting investments and ensuring a smooth user experience.

Case Studies of Successful Crypto Coin Apps

One prominent example of a successful crypto coin app is Coinbase. Launched in 2012, it has grown exponentially due to its user-friendly interface and robust security measures. Its marketing strategies, including educational initiatives and referral programs, have helped attract millions of users.Leading applications often utilize user engagement tactics like push notifications for price alerts and educational content to keep users informed and active within the app.

Such strategies not only foster a loyal user base but also encourage new users to join the platform.

Creating Your Own Crypto Coin App

Developing a crypto coin application involves several steps, including market research, defining your target audience, and determining the app’s core features. Essential features typically include secure wallet integration, real-time market tracking, and user-friendly navigation.Identifying potential funding sources, such as venture capital or partnerships with established financial institutions, is crucial for app development. Collaborating with experienced developers can also enhance the chances of success in a competitive marketplace.

Epilogue

In summary, the rise of crypto coin apps in the USA signifies a transformative shift in how we engage with financial assets. As technology continues to evolve, staying informed about the features, risks, and advancements in these applications will empower users to make savvy decisions in the world of cryptocurrency.

FAQ Summary

What is a crypto coin app?

A crypto coin app is a mobile or web application that allows users to buy, sell, and manage cryptocurrencies.

How do I choose the best crypto coin app?

Consider factors like security features, user reviews, fees, and available cryptocurrencies before choosing an app.

Are crypto coin apps safe to use?

While many apps employ strong security measures, always do thorough research and enable two-factor authentication.

Can I use a crypto coin app for trading?

Yes, most crypto coin apps offer trading capabilities, allowing users to buy and sell various cryptocurrencies.

What fees are associated with crypto coin apps?

Fees vary by app and can include transaction fees, withdrawal fees, and trading fees, so it’s important to review them carefully.