With ethereum vs solana vs avalanche taking center stage, we delve into the exciting landscape of blockchain technology, where innovative platforms are reshaping our digital world. These three contenders are not just platforms; they each represent unique philosophies and technological advancements that cater to different needs within the blockchain ecosystem.

Ethereum, Solana, and Avalanche each boast distinctive features and architectures that influence their performance, scalability, and use cases. From Ethereum’s pioneering smart contracts to Solana’s blazing fast transaction speeds and Avalanche’s innovative consensus mechanism, understanding these platforms is essential for anyone interested in the future of decentralized applications and finance.

Overview of Blockchain Platforms

Blockchain technology has revolutionized how we perceive data management and transactions, forming the backbone for cryptocurrencies like Ethereum, Solana, and Avalanche. Each of these platforms utilizes decentralized networks to ensure transparency and security, but they differ significantly in their architecture, consensus mechanisms, and scalability solutions.Ethereum, built on a proof-of-work system before transitioning to proof-of-stake, emphasizes smart contracts, allowing developers to create decentralized applications (dApps).

In contrast, Solana employs a unique architecture that integrates proof-of-history, resulting in impressive transaction speeds and low costs. Avalanche, on the other hand, uses a multi-chain architecture and a novel consensus mechanism called Avalanche consensus, which enhances performance and security.The scalability of these blockchain platforms varies widely. Ethereum has faced challenges with congestion and high gas fees, especially during peak usage times.

Solana solves many of these issues by enabling thousands of transactions per second without compromising security or decentralization. Avalanche showcases a robust system that can process thousands of transactions in a few seconds, offering a compelling option for developers seeking efficiency without sacrificing security.

Ethereum: Features and Innovations

Ethereum stands out due to its pioneering approach to smart contracts and its upcoming transition to proof-of-stake. The key features that distinguish Ethereum include its extensive developer community, robust ecosystem, and a wide array of applications ranging from DeFi to NFTs.The transition to proof-of-stake is crucial for Ethereum’s scalability and sustainability. This shift reduces energy consumption significantly, making the platform more accessible for developers and users alike.

With proof-of-stake, Ethereum allows for faster transaction times and lower costs, enhancing the overall user experience.Smart contracts are a critical component of Ethereum’s ecosystem, enabling self-executing contracts with the terms directly written into code. Successful applications built on Ethereum include Uniswap, a decentralized exchange, and Cryptokitties, a digital collectibles game that famously congested the network during its launch. These examples illustrate the potential and versatility of Ethereum’s smart contracts in transforming industries.

Solana: Performance and Use Cases

Solana’s architecture is designed for high throughput, achieving lightning-fast transaction speeds and minimal costs. The platform’s unique combination of proof-of-history and proof-of-stake allows it to process thousands of transactions per second, catering to high-demand applications.The advantages of Solana’s ecosystem are evident in its growing list of prominent projects. Notable examples include Serum, a decentralized exchange offering high-speed trading, and Audius, a decentralized music streaming platform that empowers artists and listeners alike.

These projects illustrate Solana’s capability to support diverse and innovative use cases while providing a seamless user experience.The proof-of-history consensus mechanism is crucial for Solana’s efficiency. By timestamping transactions before they’re processed, it drastically reduces the time required to validate blocks, enhancing overall network performance. This approach not only boosts transaction speed but also lowers costs, making it an attractive option for developers and users.

Avalanche: Unique Selling Points

Avalanche boasts a unique architecture that balances scalability with security. Its multi-chain design allows various blockchains to operate concurrently, each tailored to specific use cases while maintaining the core principles of decentralization and interoperability.Avalanche employs its consensus mechanism, distinct from Ethereum’s proof-of-work and Solana’s proof-of-history. This Avalanche consensus enables rapid confirmation times and high transaction throughput without compromising security, making it suitable for high-performance applications.Real-world use cases of Avalanche are becoming increasingly prominent.

Projects such as Pangolin, a decentralized exchange, and the Avalanche-Ethereum Bridge, which facilitates asset transfers between the two platforms, highlight the capabilities and flexibility of the Avalanche ecosystem. This demonstrates that Avalanche is not just theoretical but is actively shaping the future of blockchain technology.

Comparative Analysis: Ethereum, Solana, and Avalanche

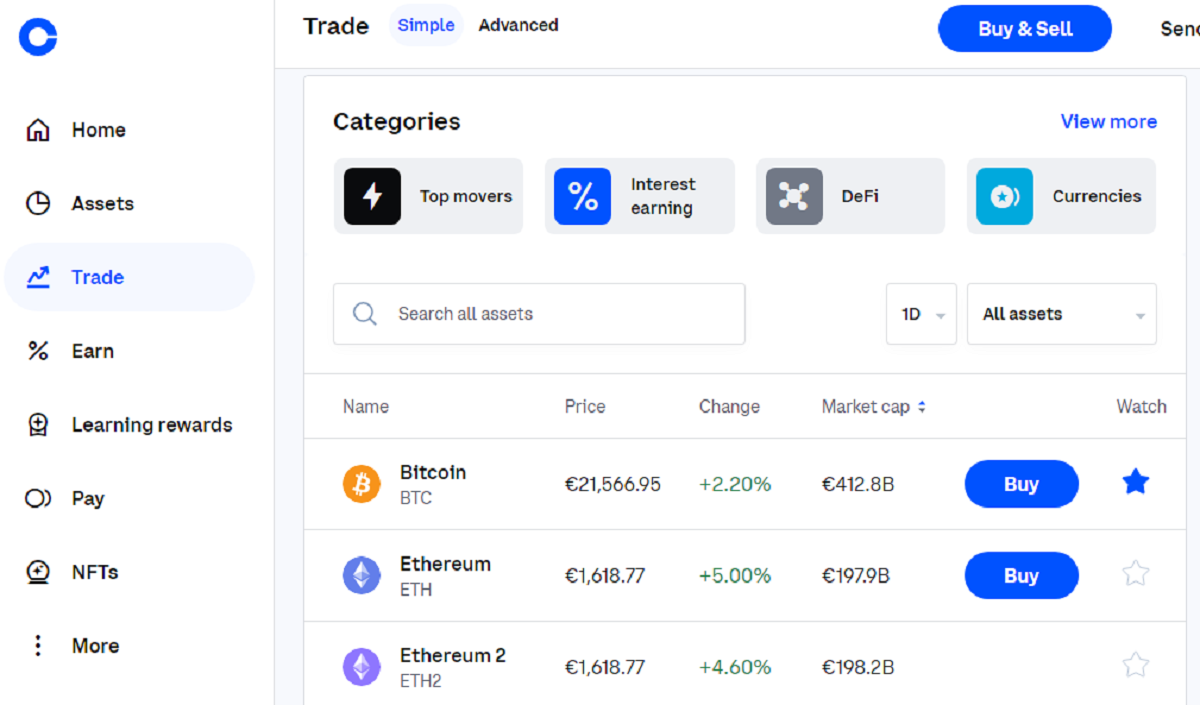

A comparative analysis of Ethereum, Solana, and Avalanche reveals key differences in transaction speed, costs, and scalability.

| Platform | Transaction Speed | Average Transaction Cost | Scalability |

|---|---|---|---|

| Ethereum | 15 transactions per second | $2-$10 | High, but congested during peak times |

| Solana | 65,000 transactions per second | $0.001 | Very high, designed for high demand |

| Avalanche | 4,500 transactions per second | $0.01 | High, with multiple chains for different applications |

When evaluating the pros and cons of each platform, developers may consider Ethereum for its mature ecosystem and extensive resources, despite its higher costs. Solana offers unbeatable speed and low fees, making it ideal for high-frequency applications, while Avalanche provides a balanced approach for those seeking both speed and security.Community support and developer resources also play a pivotal role in the adoption of these platforms.

Ethereum has a well-established community with extensive documentation, tutorials, and support forums. Solana’s rapid growth has led to an enthusiastic developer community, while Avalanche is gaining traction with a focus on education and accessibility.

Future Prospects and Trends

Looking ahead, Ethereum is poised for ongoing improvements, particularly with the full implementation of its proof-of-stake model and sharding to enhance scalability. Expect to see more innovative dApps and DeFi projects as the ecosystem continues to evolve.Emerging trends that could influence the growth of these platforms include regulatory changes that may impact how decentralized finance operates, as well as technological advancements like layer 2 solutions that enhance scalability and speed across all platforms.Each platform may face anticipated challenges as they evolve.

Ethereum needs to address its scalability issues to keep up with demand. Solana must maintain its performance as it grows to ensure that it doesn’t compromise on decentralization. Avalanche has the task of expanding its ecosystem while retaining security and usability, navigating the complexities of multi-chain interactions.

Outcome Summary

In conclusion, the battle of ethereum vs solana vs avalanche reveals a fascinating interplay of technology, innovation, and community support. Each platform has carved out its niche, offering unique advantages and facing distinct challenges as they evolve. By staying informed about their developments and trends, users and developers can make more informed decisions in this dynamic blockchain environment.

Key Questions Answered

What is the main difference in transaction speed among these platforms?

Ethereum is generally slower due to its proof-of-stake transition, Solana boasts very high speeds with its unique architecture, while Avalanche offers competitive speeds through its consensus mechanism.

How do the consensus mechanisms differ across these platforms?

Ethereum uses proof-of-stake, Solana employs proof-of-history, and Avalanche utilizes a unique consensus model that combines aspects of both proof-of-stake and practical Byzantine fault tolerance.

Which platform is better for developers?

This often depends on the project; Ethereum has extensive community support and resources, Solana offers speed and low costs, while Avalanche excels in scalability and security.

What are some notable projects on each platform?

Ethereum hosts projects like Uniswap and Aave, Solana supports Serum and Mango Markets, and Avalanche is home to platforms like Pangolin and Benqi.

Are there any significant challenges facing these blockchain platforms?

Yes, Ethereum faces scaling issues and high fees, Solana has encountered network outages, and Avalanche must prove its security and adoption against established competitors.

/stack-of-ether-coins-with-gold-background-901948904-a546d2200ec44115a4c219bce36f88bf.jpg)